The cryptocurrency landscape has evolved significantly since the inception of Bitcoin in 2009. Among the myriad digital assets that have emerged, two distinct categories stand out: traditional cryptocurrencies and meme coins. Understanding the differences between these two is crucial for investors and enthusiasts alike.

Contents

- Understanding Traditional Cryptocurrencies

- Exploring Meme Coins

- Comparative Analysis: Meme Coins vs. Traditional Cryptocurrencies

- Investment Considerations

- Case Studies

- Regulatory Perspectives

- Conclusion

- Frequently Asked Questions (FAQs)

- How do meme coins differ from traditional cryptocurrencies?

- Can meme coins become mainstream?

Understanding Traditional Cryptocurrencies

Definition and Purpose

Traditional cryptocurrencies are digital or virtual currencies that utilize cryptography for security and operate on decentralized networks based on blockchain technology. Their primary purpose is to facilitate secure, peer-to-peer transactions without the need for intermediaries like banks.

Key Characteristics

- Technology and Security: Traditional cryptocurrencies employ blockchain technology, ensuring transparency and immutability of transactions. Advanced cryptographic techniques safeguard the network against fraud and cyberattacks.

- Utility and Adoption: Many traditional cryptocurrencies offer functionalities beyond simple transactions. For instance, Ethereum introduced smart contracts, enabling decentralized applications (dApps) to operate on its platform. Such utilities have led to widespread adoption across various industries.

- Market Stability: While still volatile compared to traditional fiat currencies, established cryptocurrencies like Bitcoin and Ethereum have shown relative stability over time, attracting institutional investors and gaining recognition as potential stores of value.

Examples of Traditional Cryptocurrencies

- Bitcoin (BTC): Launched in 2009 by an anonymous entity known as Satoshi Nakamoto, Bitcoin was the first cryptocurrency and remains the most valuable by market capitalization. It is often referred to as “digital gold” due to its limited supply and deflationary nature.

- Ethereum (ETH): Introduced in 2015 by Vitalik Buterin, Ethereum is a decentralized platform that enables developers to build and deploy smart contracts and dApps. Its native currency, Ether, is used to power these applications and has become a cornerstone of the decentralized finance (DeFi) ecosystem.

Exploring Meme Coins

Definition and Origin

Meme coins are cryptocurrencies inspired by internet memes, trends, or characters. They are typically designed with a sense of humor and are associated more with entertainment than practical utility.

Key Characteristics

- Community-Driven Nature: Meme coins thrive on the strength of their online communities. Platforms like Reddit and Twitter play pivotal roles in promoting these coins, often leading to rapid increases in value driven by social media trends.

- Volatility and Speculation: Due to their reliance on community sentiment, meme coins are highly volatile. Their prices can skyrocket based on viral trends or endorsements but can plummet just as quickly.

- Limited Utility: Unlike traditional cryptocurrencies that offer tangible utilities, meme coins often lack inherent value or practical applications. Their worth is predominantly speculative, based on the collective belief of their community.

Examples of Meme Coins

- Dogecoin (DOGE): Created in 2013 by software engineers Billy Markus and Jackson Palmer as a joke, Dogecoin features the Shiba Inu dog from the “Doge” meme as its logo. Despite its origins, it has garnered a significant following and has been used in various charitable events and crowdfunding campaigns.

- Shiba Inu (SHIB): Launched in 2020, Shiba Inu positions itself as a “Dogecoin killer.” It gained rapid popularity, especially after being listed on major cryptocurrency exchanges, and has developed its own decentralized exchange called ShibaSwap.

Comparative Analysis: Meme Coins vs. Traditional Cryptocurrencies

Technological Foundations

- Blockchain and Consensus Mechanisms: Both traditional cryptocurrencies and meme coins operate on blockchain technology. However, traditional cryptocurrencies often employ more robust consensus mechanisms like Proof of Work (PoW) or Proof of Stake (PoS), ensuring higher security and decentralization. In contrast, many meme coins are forks of existing blockchains and may not introduce novel technological advancements.

- Development Teams and Governance: Traditional cryptocurrencies typically have dedicated development teams and structured governance models, ensuring continuous improvement and adherence to roadmaps. Meme coins, on the other hand, may lack formal development teams, leading to concerns about long-term viability and security.

Market Dynamics

- Price Volatility: While all cryptocurrencies are subject to volatility, meme coins experience more extreme fluctuations due to their speculative nature and susceptibility to social media trends. Traditional cryptocurrencies, especially those with larger market capitalizations, tend to exhibit relatively lower volatility.

- Market Capitalization and Liquidity: Traditional cryptocurrencies like Bitcoin and Ethereum boast high market capitalizations and liquidity, facilitating large transactions without significant price impact. Meme coins, however, often have smaller market caps and lower liquidity, making them more susceptible to price manipulation.

Utility and Adoption

- Real-World Applications: Traditional cryptocurrencies have found applications in various sectors, including finance, supply chain, and healthcare. Their underlying technologies enable functionalities like smart contracts, decentralized finance, and cross-border payments. Meme coins generally lack such utilities and are primarily used for speculative trading.

- Institutional Acceptance: Established cryptocurrencies have seen growing acceptance among institutions and businesses, with some companies integrating them into their payment systems or investment portfolios. Meme coins, due to their volatility and perceived lack of seriousness, have not achieved similar levels of institutional adoption.

Investment Considerations

Risk Assessment

- Volatility and Market Sentiment: Investing in meme coins is akin to riding a roller coaster; their values can surge or crash based on social media trends, celebrity endorsements, or internet memes. Traditional cryptocurrencies, while still volatile, often have more predictable movements influenced by broader economic factors.

- Regulatory Environment: Traditional cryptocurrencies are increasingly subject to regulatory scrutiny, leading to clearer guidelines and investor protections. Meme coins, being newer and less established, may face uncertain regulatory futures, adding another layer of risk for investors.

Potential Returns

- Short-Term Gains: Meme coins have the potential for substantial short-term gains, especially during viral trends. For instance, Dogecoin experienced a significant surge in value following endorsements from high-profile individuals. However, these gains are often fleeting, and the subsequent declines can be steep.

- Long-Term Value: Traditional cryptocurrencies like Bitcoin and Ethereum have demonstrated resilience and growth over time, attracting long-term investors. Their established use cases and ongoing development contribute to their sustained value. In contrast, meme coins often lack a clear roadmap or utility, making their long-term prospects uncertain.

Investor Profiles

- Risk Tolerance: Investors with a high risk tolerance may be drawn to meme coins due to their potential for rapid gains. However, it’s essential to recognize the heightened risk of significant losses. Traditional cryptocurrencies may appeal to those seeking a balance between risk and stability.

- Investment Goals: Short-term traders might find meme coins attractive for speculative opportunities. Conversely, individuals aiming for long-term wealth accumulation may prefer traditional cryptocurrencies with proven track records and broader acceptance.

Case Studies

Dogecoin’s Market Surge

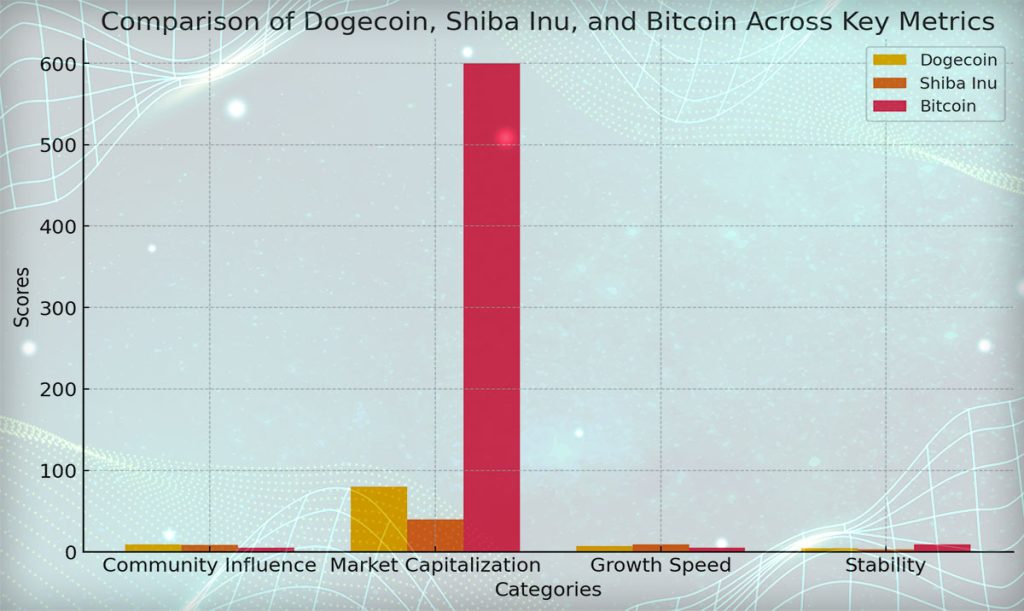

Dogecoin, initially created as a joke, saw its market capitalization soar to over $80 billion in 2021, propelled by social media buzz and endorsements from celebrities like Elon Musk. This surge exemplifies how meme coins can achieve rapid value increases driven by community enthusiasm rather than intrinsic value.

Shiba Inu’s Rapid Rise

Shiba Inu, dubbed the “Dogecoin killer,” experienced a meteoric rise in 2021, entering the top 20 cryptocurrencies by market capitalization within a year of its launch. Its growth was fueled by a dedicated community and strategic marketing, highlighting the power of social dynamics in the meme coin space.

Bitcoin’s Stability and Growth

Bitcoin, the pioneer of cryptocurrencies, has maintained its position as the leading digital asset by market capitalization. Its adoption by institutional investors and recognition as a potential hedge against inflation have contributed to its sustained growth and relative stability compared to meme coins.

Regulatory Perspectives

Current Regulatory Landscape

Traditional cryptocurrencies are increasingly subject to regulatory scrutiny, with governments implementing frameworks to address issues like money laundering and investor protection. Meme coins, due to their novelty and speculative nature, often operate in a regulatory gray area, posing additional risks to investors.

Future Outlook

As the cryptocurrency market evolves, regulatory bodies may develop more comprehensive guidelines encompassing both traditional cryptocurrencies and meme coins. Increased regulation could lead to greater investor protection but might also impact the speculative appeal of meme coins.

Conclusion

Understanding the distinctions between meme coins and traditional cryptocurrencies is essential for making informed investment decisions. While meme coins offer opportunities for short-term gains driven by community sentiment, they come with heightened risks due to their volatility and lack of intrinsic value. Traditional cryptocurrencies, with their established use cases and growing adoption, may provide more stable investment opportunities. Investors should carefully assess their risk tolerance and investment objectives when navigating the diverse cryptocurrency landscape.

Frequently Asked Questions (FAQs)

What is a meme coin in crypto?

A meme coin is a type of cryptocurrency inspired by internet memes or trends, often created as a joke or parody. These coins typically lack intrinsic value and are driven by community sentiment and social media influence.

Are meme coins a good investment?

Investing in meme coins is highly speculative and carries significant risk due to their volatility and lack of inherent utility. While some investors have realized short-term gains, others have experienced substantial losses. It’s crucial to conduct thorough research and consider one’s risk tolerance before investing in meme coins.

How do meme coins differ from traditional cryptocurrencies?

Meme coins differ from traditional cryptocurrencies in several ways:

- Purpose: Traditional cryptocurrencies are designed for secure transactions and may offer additional functionalities like smart contracts. Meme coins are often created for entertainment or as a joke.

- Utility: Traditional cryptocurrencies have real-world applications and are accepted by various businesses. Meme coins generally lack practical use cases.

- Volatility: Meme coins are more susceptible to price swings driven by social media trends, whereas traditional cryptocurrencies, while still volatile, tend to have more stable value influenced by broader economic factors.

Can meme coins become mainstream?

While some meme coins have gained significant attention and market capitalization, their path to mainstream adoption is uncertain. Factors such as regulatory developments, technological advancements, and shifts in public perception will play crucial roles in determining their future acceptance.

What should I consider before investing in meme coins?

Before investing in meme coins, consider the following:

- Research: Understand the coin’s origin, community, and purpose.

- Risk Tolerance: Assess your ability to withstand potential losses due to high volatility.

- Diversification: Avoid allocating a significant portion of your portfolio to meme coins.

- Regulatory Environment: Stay informed about legal considerations and potential regulatory changes affecting cryptocurrencies.

By carefully evaluating these factors, investors can make more informed decisions in the dynamic world of cryptocurrencies.

References